Start Small, Think Big with America Saves!

Make a commitment to yourself to save money, reduce your debt, and begin building wealth. Take the America Saves Pledge, choose a savings goal, and America Saves will send you tips, resources, and tools to help you be successful. Think of us as your savings accountability partner.

Take the America saves pledge

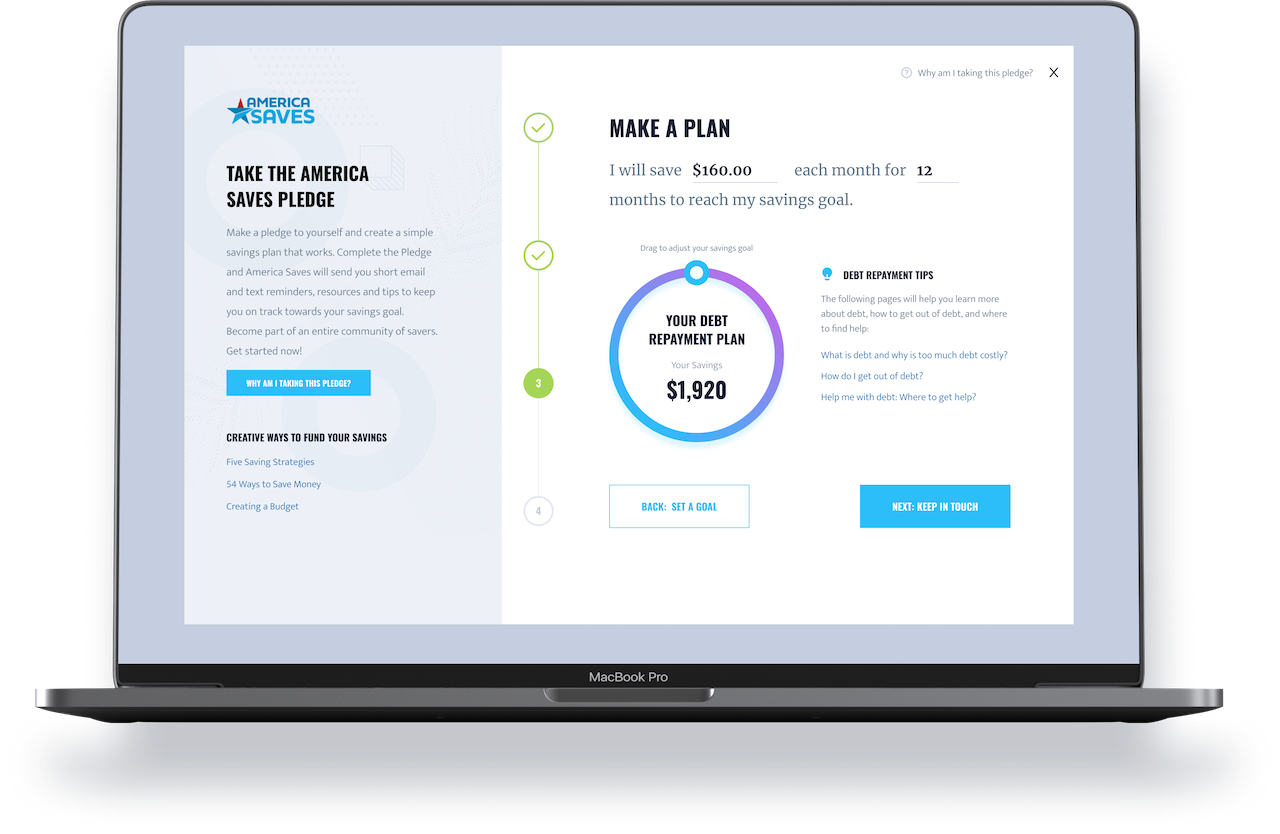

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and America Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the America Saves Pledge is a pledge to yourself to start a savings journey and America Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

Organizations: Join Us For America Saves Week

Encourage your community to do a financial check-in and get a clear view of their finances.

Find a Local Campaign

Connect with a local campaign for one-on-one help and to learn more about savings initiatives and events in your area.

What are you saving for?

Depending on your goal your approach to saving changes! Choose a topic to explore and learn more about how to save successfully and effectively in that specific area.

Do you have a saving tip or story you want to share with us?

If we feature you in our newsletter, you get $50.

TAKE THE AMERICA SAVES PLEDGE

Make a commitment to yourself and create a simple savings plan that actually works! Take the America Saves Pledge and we’ll send you short emails, text reminders, resources, and tools to keep you on track toward your savings goal Become a part of an entire community of Savers. Get started now!

Take the America saves pledge

Make a pledge to yourself and create a simple savings plan that works. Complete the Pledge and America Saves will send you short email and text reminders, resources and tips to keep you on track towards your savings goal. Become part of an entire community of savers. Get started now!

creative ways to fund your savings

Those with a savings plan are twice as likely to save successfully. Taking the America Saves Pledge is a pledge to yourself to start a savings journey and America Saves is here to encourage you along the way. Take the first step toward creating a better financial future. Make a plan, set a goal, and pledge to yourself to start saving, today.

Congrats on completing the pledge!

What's New?

Sample Social Media Content - October 2025

Ready-to-use graphics and sample posts designed for Financial Planning Month. Ideal for partners promoting credit awareness across digital channels.

02.06.2024 By Amy Miller, AFC

First-Time Homebuyers: Where to Start

Excited! Scared! Anxious! Nervous! These are all normal emotions when starting the home-buying process for the first time. There are a lot of things to research, review, consider, and do throughout the process that can seem overwhelming for most first-timers.

12.19.2023 By Amy Miller

Staying on Track with Your Spending & Savings Plan

Here are some tried-and-true strategies that can help keep you focused and on track with your plans.

02.06.2024 By Amanda Woods

Being Financially Secure When You Or A Loved One Has A Disability

We know that families who are living with disabilities may often face unique financial considerations, but building financial security is well within reach for you and your loved ones! Everyone deserves to feel financially confident, and by understanding how to navigate the financial challenges that may arise, as well as by understanding the resources and tools available to you, you’ll have what you need to live life to the fullest without financial stress becoming an unnecessary barrier.

By Amy Miller

Talking About Finances As a Family

Money is a sensitive subject and talking about it, even with those closest to you, can almost seem taboo at times. However, it’s important to discuss money management and financial goals as a family. And these conversations about money aren’t just limited to your spouse and children. It’s important to also discuss finances with your parents and other important loved ones as well.

02.06.2024 By Amanda Woods

Finding Grants & Scholarships

Planning for your next educational adventure can be such an exciting time, but the question of how you’ll pay for your college (or trade school!) experience can add some stress to the mix. But don’t worry, it doesn’t have to be stressful. With options like scholarships and grants available, there is financial aid waiting to help ease the financial burden of your journey to higher education. If college is on the horizon and you’re looking to learn a little more about the grants and scholarships available to you, we’re here to help

02.05.2024 By Kia McCallister-Young

Questions to Ask Yourself when Saving for Retirement

Are you saving for retirement? For many of us, saving for retirement is simply signing up for our employer's 401K or Thrift Savings Plan, choosing a contribution percentage, and calling it a day.

02.06.2024 By Amy Miller, AFC

What is a Credit Score?

We all know credit is important when applying for a home mortgage, auto loan, or credit card, but many are surprised to learn that employers, utility companies, and insurance agencies also check credit to determine how you pay your bills and if you are hirable or insurable.

54 Ways to Save Money

You’ve just taken the America Saves Pledge, or perhaps you simply need some inspiration for ways to save your money -- either way, we’re glad you’re here. Buckle up! It’s about to get REAL around here as we share 54 ideas to save some dinero. Let’s dive in by first establishing some general savings ideas to get you #ThinkingLikeASaver.

01.09.2023 By Amy Miller, AFC®

15 Ways to Earn Extra Money

Like many of us, you may have found that you could use a little more money this year. Whether you’re trying to save, pay off debt or just make ends meet, some extra cash could go a long way.

12.08.2022 By Amy Miller, AFC®

What You Need To Know About Setting A Monthly Money Date

Many Americans don’t have an accurate idea of the true state of their own finances, and around one-third are surprised to find that their situation is different than they thought. This, along with the new year approaching, will lead many of us to set some resolutions around improving our financial health and wellbeing.

12.08.2022 By Amy Miller, AFC®

SAVING FOR YOUR PAST, PRESENT, AND FUTURE: THE 30/40/30 RULE

Our approach to handling a windfall is a simple and easy way to manage what you spend and save and can help you to do the best you can when you have additional funds available. This plan is known as the 30/40/30 Rule.

By Kia Young

How to Start Your Savings Journey

So you’ve decided that it’s time for you to get (more) serious about your finances, particularly saving. Great! This is a critical moment that happens for most working-class Americans, no matter how much money you’re making.

06.25.2020 By Kia McCallister-Young

Creating a Spending & Savings Plan For Your Family

It’s always the right time to create a saving and spending plan (aka a budget). It’s also a good idea to revisit that plan annually or when a major shift occurs in your income or expenses.

Our Partners

America Saves' work to improve saving behavior is generously supported by a number of partners.

Set a goal and start saving today!

Learn how to save money, improve your financial life, and build wealth.

Learn MoreGetting involved

America Saves makes it easy for your organization to get involved. Take a look at the different options, and choose the best fit for you and your colleagues. We look forward to working with you!

Partner Resource Packet

Want to share savings messages? Our Partner Resources Packets include blog, social media, and other content.

05.27.2025 By Amelia Simons

Your Financial Wellness Looks Bright! Workplace emergency savings made easy, accessible, and rewarding with industry leading 3.63% APY*.

Like Us on Facebook

Follow Us on Twitter

Want to receive the latest info from America Saves?